Decoding WDROYO Auto Insurance: A Comprehensive Guide 2024 provides a detailed exploration of WDROYO’s auto insurance offerings assisting readers in understanding the various coverage options and features available.

Dive into the depths of auto insurance intricacies with Decoding WDROYO Auto Insurance: A Comprehensive Guide 2024 unraveling the complexities of coverage and premiums. Explore tailored solutions and innovative features ensuring peace of mind on every journey. Let this comprehensive guide be your beacon in navigating the maze of insurance options empowering you with knowledge and insights.

Explore ‘Decoding WDROYO Auto Insurance: A Comprehensive Guide 2024’ for an in-depth look into WDROYO’s auto insurance offerings. This comprehensive guide provides detailed insights into coverage options premium factors and innovative features. You’re a seasoned driver or new to auto insurance this resource equips you with essential knowledge to navigate the insurance landscape effectively. Dive into the world of WDROYO Auto Insurance and make informed decisions about your coverage.

Importance of Auto Insurance

Auto insurance is a crucial investment that provides financial protection against unforeseen events on the road. It acts as a safety net safeguarding not only your vehicle but also other drivers and pedestrians involved in accidents. With comprehensive coverage drivers can enjoy peace of mind knowing they have a reliable support system in place mitigating the financial burden of repairs and medical expenses.

Also read this:Why Is My Car Jerking After Oil Change?

History and Evolution of WDROYO Auto Insurance

The history of WDROYO Auto Insurance traces back to its founding principles in [Year]. Since then, it has continually evolved challenging the conventional norms of the insurance industry. Through innovative milestones and a commitment to personalized coverage WDROYO has established itself as a trusted partner for drivers seeking tailored protection on the road.

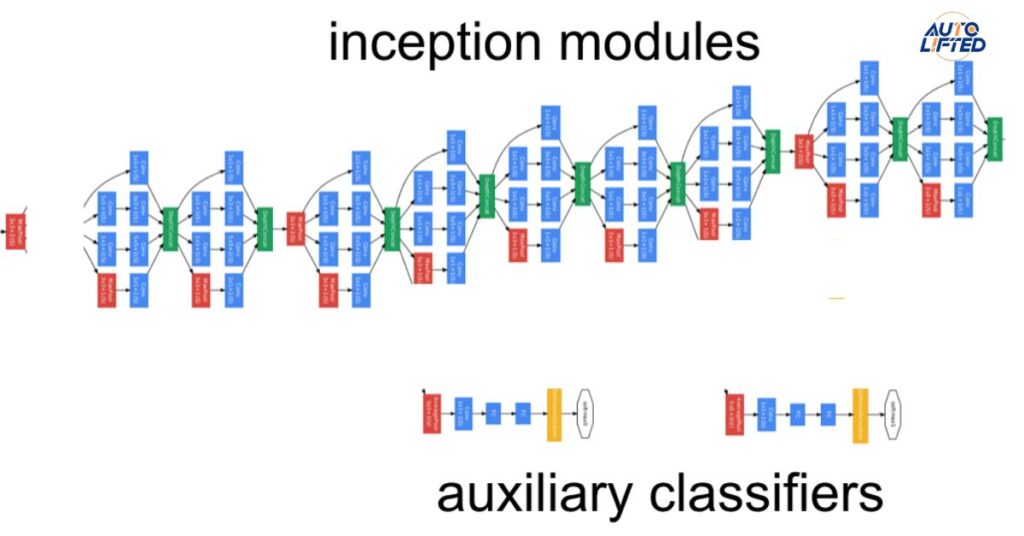

Inception and Founding Principles

Inception and Founding Principles

WDROYO Auto Insurance was born from a vision to make insurance accessible affordable and personalized.

Founded in Year the company brought together industry experts to challenge the status quo.

Their core principle emphasized flexibility ensuring coverage adapted to individual needs and driving habits.

Evolutionary Milestones in Coverage

Evolutionary milestones in coverage mark pivotal moments in the evolution of WDROYO Auto Insurance showcasing its commitment to innovation and customer-centric solutions. From pioneering pay-per-mile options to integrating cutting-edge telematics technology WDROYO has continuously raised the bar in the insurance industry. These milestones not only demonstrate WDROYO’s adaptability to changing customer needs but also highlight its dedication to staying ahead of the curve in providing comprehensive and tailored coverage options.

Types of WDROYO Auto Insurance Policies

WDROYO Auto Insurance offers a diverse range of coverage options tailored to meet the individual needs and preferences of drivers. These include comprehensive coverage collision coverage liability coverage and uninsured/underinsured motorist coverage. Each policy is designed to provide extensive protection against various risks on the road ensuring peace of mind for WDROYO customers regardless of their driving experience or vehicle type.

WDROYO Auto Insurance offers a range of policies designed to cater to diverse driver needs:

Comprehensive Coverage: Provides protection against physical damage to your vehicle from collisions theft vandalism and natural disasters as well as liability for injuries or property damage to others.

Collision Coverage: Covers repairs to your car following a collision regardless of fault offering peace of mind, especially for owners of newer or expensive vehicles.

Liability Coverage: Protects financially against injuries or property damage you cause to others in an accident, encompassing bodily injury and property damage liability.

Uninsured/Underinsured Motorist Coverage: Offers financial support if you’re hit by a driver without insurance or sufficient coverage serving as a safety net against the uncertainties of the road.

Benefits and Features of WDROYO Auto Insurance

WDROYO Auto Insurance offers a comprehensive array of benefits and features tailored to meet your needs. With a focus on customer satisfaction and peace of mind WDROYO provides:

Affordable Premiums: Enjoy competitive rates that won’t break the bank ensuring you get the coverage you need without sacrificing your budget.

24/7 Customer Support: Whether you have a question about your policy or need assistance during an emergency WDROYO’s dedicated customer support team is available around the clock to provide you with prompt and reliable assistance.

Flexible Coverage Options: From basic liability coverage to comprehensive protection, WDROYO offers a range of customizable options to suit your specific requirements ensuring you’re adequately covered no matter what life throws your way.

Customization Options for Policyholders

Policyholders at WDROYO Auto Insurance benefit from a plethora of customization options tailored to their individual needs. Whether you’re seeking basic coverage or comprehensive protection WDROYO offers flexibility to adjust your policy according to your unique circumstances.

Roadside Assistance and Additional Services

Roadside assistance and additional services offered by WDROYO Auto Insurance are designed to provide policyholders with peace of mind and support in unexpected situations. With our comprehensive roadside assistance program policyholders can rely on prompt assistance for common roadside issues such as flat tires dead batteries and lockouts.

Discounts and Incentives for Customers

At WDROYO Auto Insurance we understand the value of providing our customers with discounts and incentives that help them save money while still receiving top-notch coverage. We offer a variety of discounts tailored to fit different lifestyles and circumstances such as safe driver discounts for those with a clean driving record multi-policy discount for customers who bundle their insurance policies and discounts for vehicles equipped with safety features like anti-theft devices or airbags.

Understanding WDROYO’s Claim Process

Understanding WDROYO’s claim process is essential for a seamless experience. From reporting the claim to assessment and settlement, our experts provide clear guidance every step of the way. With efficient handling and transparent communication, we strive to minimize stress and maximize satisfaction for our policyholders.

Initiating a Claim

Initiating a claim with WDROYO is a simple process designed to alleviate stress during difficult times. You can easily report your claim online over the phone or through our mobile app, and our dedicated team will guide you through the next steps with care and efficiency. Rest assured that we prioritize quick assessment and resolution to get you back on track as smoothly as possible.

Documentation Requirements

When it comes to documentation requirements with WDROYO we strive to make the process as convenient as possible. We typically require basic information such as your policy details incident report and any relevant photos or receipts. Our goal is to ensure a thorough review while minimizing the paperwork burden on our valued customers.

Factors Influencing WDROYO Auto Insurance Rates

The WDROYO Auto Insurance rates are influenced by multiple factors including your driving history, the type of vehicle insured and your location. Factors such as coverage options and eligibility for discounts also play a role in determining your insurance premium.

Driving History and Record

Your driving history and record are significant factors influencing WDROYO Auto Insurance rates. A clean driving record with no accidents or violations typically results in lower premiums whereas a history of accidents or traffic violations may lead to higher rates due to increased perceived risk.

Vehicle Type and Age

The type and age of your vehicle significantly impact WDROYO Auto Insurance rates. Generally newer and safer vehicles may qualify for lower premiums due to their reduced risk of accidents and theft while older vehicles or those with higher repair costs may result in higher insurance rates.

Location and Demographics

Location and demographics play a crucial role in determining WDROYO Auto Insurance rates. Factors such as the area’s crime rate population density and demographic characteristics can influence the likelihood of accidents and theft impacting insurance premiums accordingly.

Comparing WDROYO Auto Insurance with Competitors

When comparing WDROYO Auto Insurance with competitors several key factors highlight our advantages:

Customizable Coverage: WDROYO offers highly customizable coverage options allowing policyholders to tailor their plans to fit their specific needs and budget.

Dedicated Customer Support: With 24/7 customer support WDROYO ensures that assistance is always available whenever policyholders need it distinguishing us from competitors with limited support hours.

Competitive Rates: WDROYO provides competitive rates without compromising on coverage quality making us a cost-effective choice compared to competitors with higher premiums for similar coverage levels.

WDROYO Auto Insurance for Special Cases

WDROYO Auto Insurance caters to special cases with tailored solutions. Whether it’s high-risk driver’s classic car owners or those with unique coverage needs WDROYO provides specialized policies to ensure comprehensive protection and peace of mind.

High-Risk Drivers

For high-risk drivers WDROYO Auto Insurance offers specialized coverage options tailored to their needs. With flexible policies and personalized support, we aim to provide affordable solutions without compromising on quality or protection.

Multiple Vehicle Coverage

WDROYO Auto Insurance offers multiple vehicle coverage to streamline protection for households with more than one car. With convenient bundling options and potential discounts, we ensure comprehensive coverage and cost savings for every vehicle under your policy.

Business and Commercial Vehicle Insurance

For business and commercial vehicle insurance WDROYO offers tailored solutions to meet the unique needs of businesses. With customizable coverage options and dedicated support, we ensure comprehensive protection for commercial vehicles fleets and businesses of all sizes.

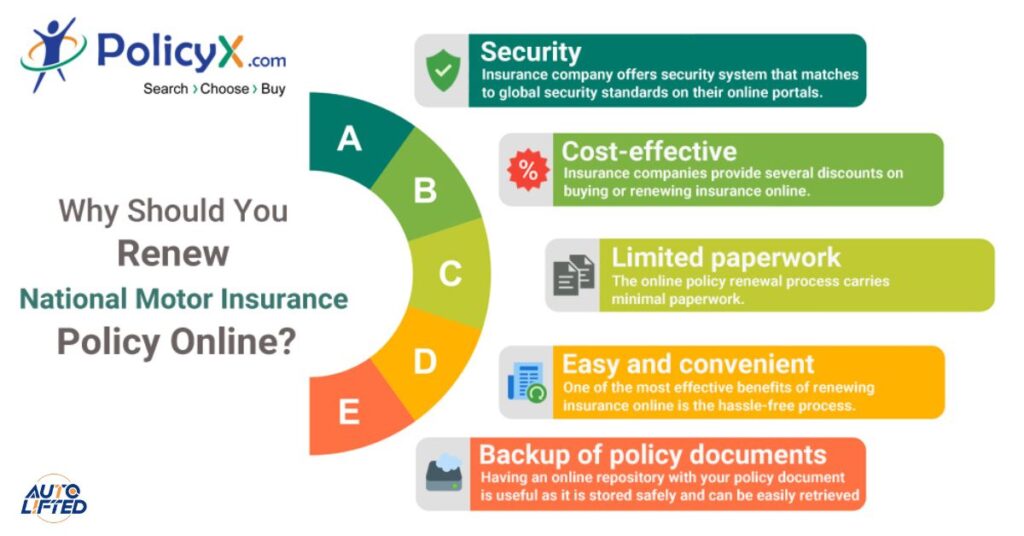

Understanding WDROYO’s Insurance Renewal Process

Understanding WDROYO’s Insurance Renewal Process is straightforward and stress-free. We provide clear communication and guidance ensuring policyholders can easily navigate their options and make informed decisions for continued coverage

Policy Renewal Procedures

At WDROYO policy renewal procedures are designed to be seamless and convenient for our customers. We provide timely reminders and simple steps to ensure a smooth transition to renewed coverage allowing policyholders to maintain continuous protection without unnecessary hassle.

Modifications and Additions

When it comes to modifications and additions to your policy with WDROYO we offer flexibility and convenience. Our streamlined process allows policyholders to easily make changes it’s adding a new driver updating coverage limits or incorporating additional vehicles ensuring your insurance adapts to your evolving needs effortlessly.

Digital Tools and Resources Offered by WDROYO

WDROYO provides a suite of digital tools and resources to enhance the insurance experience for our customers:

Online Policy Management: Easily access and manage your policy details make payments and view documents anytime anywhere through our user-friendly online portal.

Mobile App: With our mobile app you can report claims request roadside assistance and access policy information on the go ensuring convenience and peace of mind.

Educational Resources: Explore our library of informative articles FAQs and guides to help you better understand insurance concepts and make informed decisions about your coverage.

Customer Support and Service Quality at WDROYO

Customer Support and Service Quality at WDROYO are paramount to our commitment to excellence:

24/7 Assistance: Our dedicated support team is available round-the-clock to address your inquiries ensuring prompt and reliable assistance whenever you need it.

Personalized Guidance: We offer personalized guidance throughout the insurance process from policy selection to claims resolution to ensure that each customer receives tailored support.

Satisfaction Guarantee: WDROYO is dedicated to customer satisfaction striving to exceed expectations and provide a seamless and positive experience at every interaction.

Channels and Accessibility

WDROYO ensures accessibility through a variety of channels tailored to suit your preferences. You prefer traditional methods like phone and email or modern options such as online chat and mobile apps we’re committed to providing convenient and efficient service whenever you need assistance.

WDROYO’s Commitment to Community and Social Initiatives

At WDROYO we prioritize community and social initiatives as integral parts of our corporate responsibility:

Community Engagement: We actively participate in local events charitable activities and volunteer programs to give back to the communities we serve.

Social Impact Through partnerships and initiatives we aim to address social issues and contribute positively to society reflecting our commitment to making a difference beyond insurance.

Frequently Asked Questions

What is comprehensive auto?

Comprehensive auto insurance provides coverage for damages to your vehicle that are not caused by collisions, including theft vandalism and natural disasters.

What is full comprehensive insurance?

Full comprehensive insurance offers extensive coverage for your vehicle protecting against various risks such as theft vandalism natural disasters and collisions.

Which insurance is best for car?

The best insurance for a car depends on individual needs but comprehensive coverage typically offers the most extensive protection against various risks.

Do I need fully comprehensive insurance?

Whether you need fully comprehensive insurance depends on factors like your vehicle’s value your risk tolerance, and local regulations but it offers extensive protection beyond basic coverage.

Who can drive my car?

The anyone with your permission and a valid driver’s license can drive your car but insurance coverage may vary depending on the policy terms.

Conclusion

Decoding WDROYO Auto Insurance: A Comprehensive Guide 2024′ illuminates the key facets of WDROYO’s offering showcasing its commitment to customer-centric policies competitive rates and innovative digital tools. Through customizable coverage options and dedicated customer support WDROYO ensures tailored solutions for diverse needs while its transparent renewal process and seamless claim handling underscore reliability and convenience.

Emphasizing community engagement and corporate social responsibility WDROYO extends its impact beyond insurance contributing to a sustainable and inclusive future. With a focus on accessibility affordability and quality service WDROYO stands as a trusted partner in safeguarding individuals and their assets on the road.3

Passionate automotive enthusiast sharing insights, tips, and stories from the world of cars. Join me on an exhilarating journey through the roads of automotive excellence.